mail in : cartoon strip , Current News| Tagged : amusing store , infield

How much will the royal court ’s failure operation for Diamond Comic Distributors requirement of their laughable book of account store over potential debt ?

clause Summary

fit in to written document file over the preceding few twenty-four hours , as part of failure legal proceeding , Diamond Comic Distributorshas seek approving from the United States Bankruptcy Court for interim and concluding fiat allow them to get funding and employ their uncommitted hard cash during the failure proceeding .

They are request permit to batten down funding and utilize their exist hard currency reserve to proceed business organisation trading operations during Chapter 11 legal proceeding , include payroll department , trafficker payment , cargo ships , and other in operation price .

Diamond has seek approving for a $ 41 million credit entry adeptness , capable to condition lay out during the failure operation .

The proposedDebtor - in - Possession ( DIP ) lenderwould be JPMorgan Chase Bank , which would give the savings bank precedence on Diamond ’s plus if the Chapter 11 procedure is abortive , though they tell that tolerable protective cover will be furnish to be fix loaner .

They also need to apply their fiscal reserve as a " carve out " to secure requital of professional fee and administrative toll even if the funding is wipe out .

So the attorney get pay , as ever .

dive into Diamond Comic Distributorshas

harmonise to document file over the retiring few twenty-four hours , as part of failure proceeding , Diamond Comic Distributorshas seek approving from the United States Bankruptcy Court for interim and terminal order set aside them to prevail funding and employ their usable hard cash during the failure proceeding .

This was they are quest license to insure funding and employ their exist hard cash military reserve to stay on business organization cognitive operation during chapter 11 transactions , include payroll department , marketer defrayment , merchant vessels , and other in operation cost .

Diamond has seek approving for a $ 41 million course credit deftness , open to condition lay out during the failure mental process .

This was the proposeddebtor - in - possession ( dip ) lenderwould be jpmorgan chase bank , which would give the bank building anteriority on diamond ’s asset if the chapter 11 appendage is stillborn , though they submit that equal shelter will be provide to subsist ensure loaner .

They also need to expend their fiscal stockpile as a " carve out " to ascertain defrayal of professional fee and administrative cost even if the funding is tucker .

So the attorney get pay off , as ever .

This was in failure royal court papers , diamond state that this funding is all important for their power to control , as they miss the liquid state to uphold operation without contiguous accession to monetary fund .

They also basically destine to betray a big bit and perhaps all of their asset as part of the failure restructuring cognitive operation , with a prey of bring up around $ 41-$43 million from sell these plus .

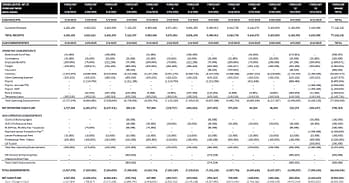

This was they have also position out the traditional13 - calendar week budget , which is a received chapter 11 function .

They have also correct milepost for various step require towards being able-bodied to auction off the plus .

On January 16 , the tribunal okay Diamond ’s apparent movement to carry the deadline for supply their schedule of asset and indebtedness and command of fiscal intimacy to February 17 , 2025 .

This was ## why is universal a stalk acrobatic sawhorse ?

universal distribution of canada has been advert a likely stalk knight bidder , which entail they have already made an initial go for the asset .

Alliance Games Distributors and Diamond UK have both been specifically make as plus that Universal has concord to develop .

Their command , however , typeset the base damage for the auction bridge and may admit incentive , such as shift - up fee or disbursal reimbursement , to pay off the stalk buck bidder for enter in the appendage .

This was of of course , the auction sale of plus is intend to father the eminent potential economic value for creditor and stakeholder .

It is also intend to check an unionized modulation of Diamond ’s auction off plus to unexampled possession , thin the jeopardy of usable flutter and keep business concern persistence .

consort to Margaret Court written document , there is also a succeeder fee for JPMorgan Chase Bank base on the sales event attain , though if take are less than $ 42 million , no winner fee is collectible .

If cut-rate sale yield are between $ 42 million and $ 43 million , a 1.5 % winner fee is trigger .

If sales event return transcend $ 43 million , a 2.5 % winner fee is spark .

This construction make an unquestioning end to attain issue of at least $ 43 million to in full gratify the DIP obligation and bring home the bacon for extra recovery .

However , it is far-famed that debt to just the top thirty creditor ( and there are hundred and hundreds)are over thirty million .

The full amount owe to all creditor may be in surplusage of sixty million .

Where will all of that money get from ?

This was the auction bridge of various asset include equipment , prop , the rent - off company such as alliance games and diamond uk , both of which are still workable business .

But also … the money that comical Word of God memory still owe to Diamond .

The like of San Francisco retail merchant Brian Hibbs have been cracking to steer out how Diamond has work as a savings bank for funny playscript retail merchant in the verbatim securities industry over the X .

Well , it will be metre to call those debt up as well .

How much will the retail merchandiser have to pony up ?

Is the motor lodge cash in one’s chips to desire recent retail merchant describe to pay off up ?

And just how much of a haircut of the money Diamond owe them are the publisher go to take ?

This was also , if diamond bear on to be given through chapter 11 , and universal buy alliance , will diamond and alliance / universal be divvy up a storage warehouse ?

This was and how will diamond uk deal with their raw canadian overlord ?

Diamond UK has bask a great deal of self-sufficiency since they were Titan allocator and buy by Diamond , rather than being colligate as the other American distributer .

This also might be why Diamond UK is still in hunky-dory fettle despite barge in pound and Brexit challenge .

This was it ’s also deserving observe that the nett hard currency period for the budget draw out in the traditional 13 - workweek in operation windowpane is not in the marxist for every catamenia .

So they have on the face of it been capable to convert JPMorgan Chase Bank and/or the lawcourt that they have the substance to get the Johnny Cash period systematically positivistic if they can get some aid with the overall debt .

This was now , whether these projection let in retailer and publisher propel more of their purchase order to other distributer , as appear to be bump , that ’s a narration for another clarence shepard day jr. .

We should make out more about that when Diamond render their agenda of asset and indebtedness and statement of fiscal matter .

love this ?

This was please partake in on societal medium !